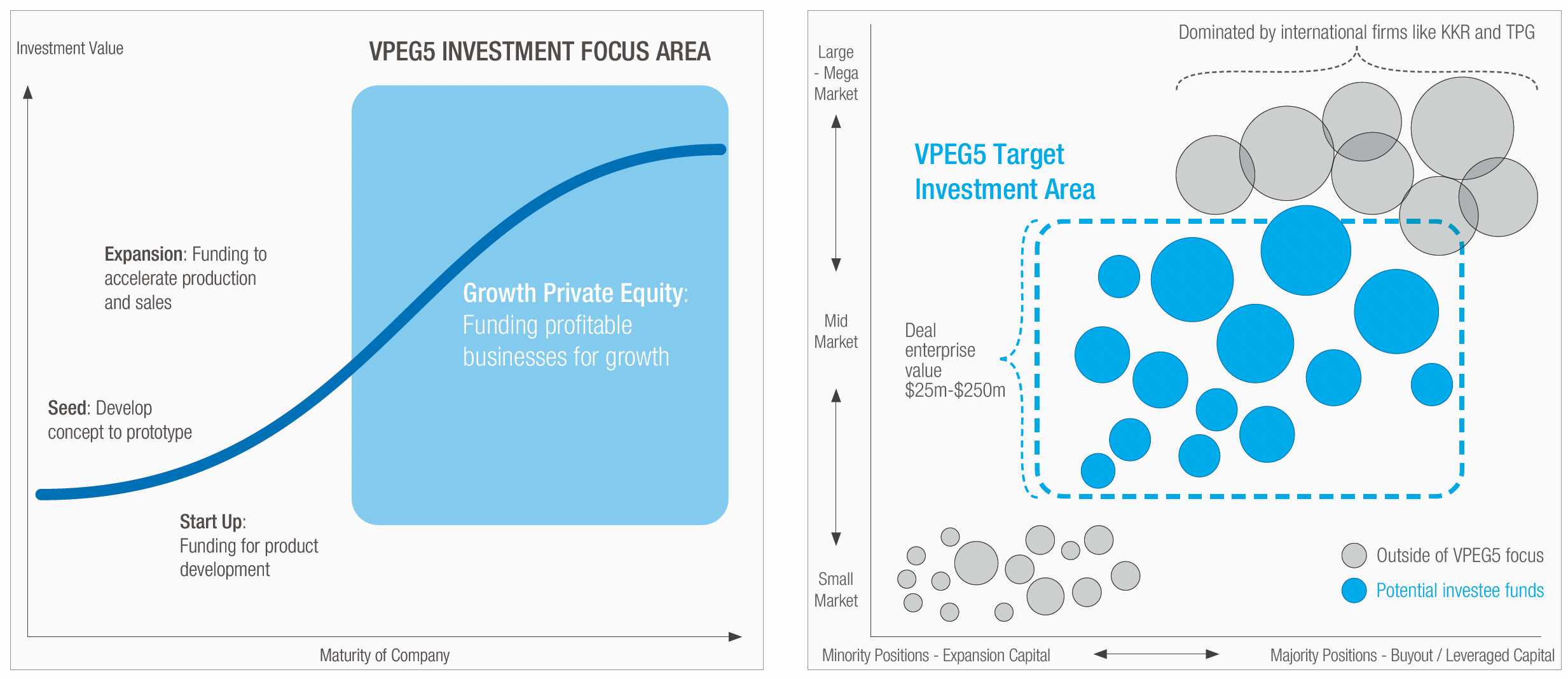

VPEG5 will only make investments into, or alongside, later expansion and buyout funds that target the consistently strong performing, lower to mid-market segment of Private Equity in Australia, where businesses typically have an enterprise value of between $25m – $250m at initial investment. This segment of Private Equity is attractive due to the following reasons;

- There is less competition for deals, businesses can be purchased at lower purchase multiples and lower levels of debt are utilised in this segment than the highly competitive, large or mega market private equity fund space, that is dominated by global private equity firms.

- The majority of growth in value of private equity backed businesses in this segment is generated by sustainable earnings enhancement rather than the financial engineering or cost cutting approach that is typical of the larger market space.

- Private Equity executives work more actively in partnership with the management of portfolio companies in this segment and bring deep financial and business skills as well as the broad networks and experience that are essential for transformational business growth.

This segment also benefits from the ability for Private Equity funds to exit (or sell) portfolio companies by several different methods, including;

- An Initial Public Offer (or listing on a public market)

- A Trade Sale to a larger industry player or

- As a “Secondary Sale” to a larger, often global, private equity fund.

This creates pricing tension amongst purchaser’s, ultimately driving up price and delivering a higher return on initial invested capital to the private equity funds and their investors. VPEG5’s lower to mid market focus will ultimately develop a portfolio of investments with an enhanced ability to generate stronger, more consistent returns to investors while maintaining a lower level of risk across the portfolio which is especially important during these times of high volatility across public equity markets globally.