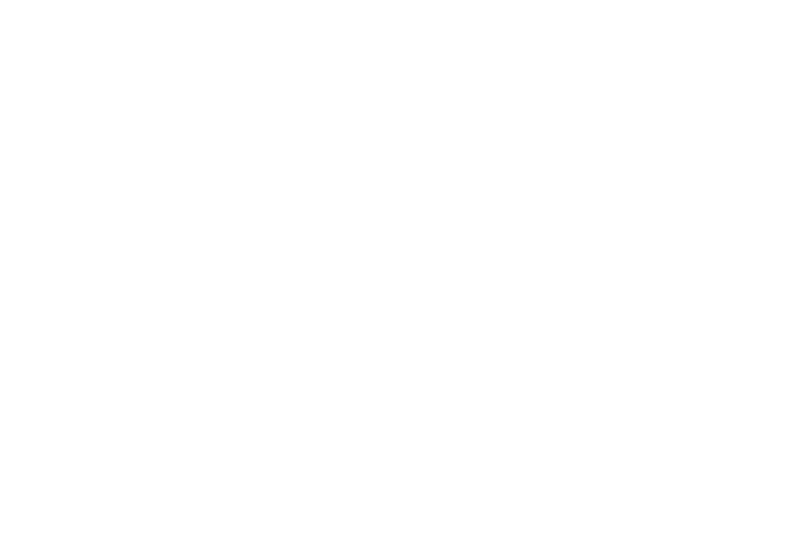

VPEG5 has been structured as a complying investment for the Investor Visa Class 188B (IV) & Significant Investor Visa Class 188C (SIV) and is also an attractive, alternative asset, investment for sophisticated investors, SMSF’s, family offices and small to mid-sized institutions. An investment in VPEG5 suits a range of investors due to the following reasons:

A Complying Investment For The Significant Investor Visa

The Fund’s structure enables Investors seeking to apply to the Australian government for a Subclass 188B and 188C Visa to meet the mandated minimum $500,000 for Investor Visa applicants or $1,000,000 for Significant Investor Visa applicants at the time of investment for the Venture Capital or Growth Private Equity Funds (VCPE) sector.

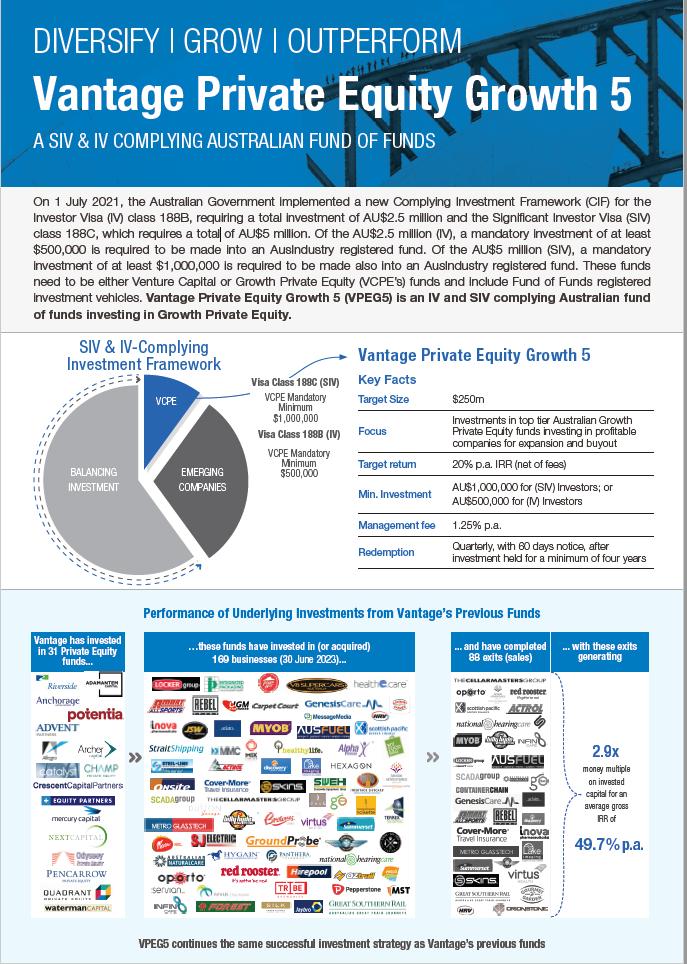

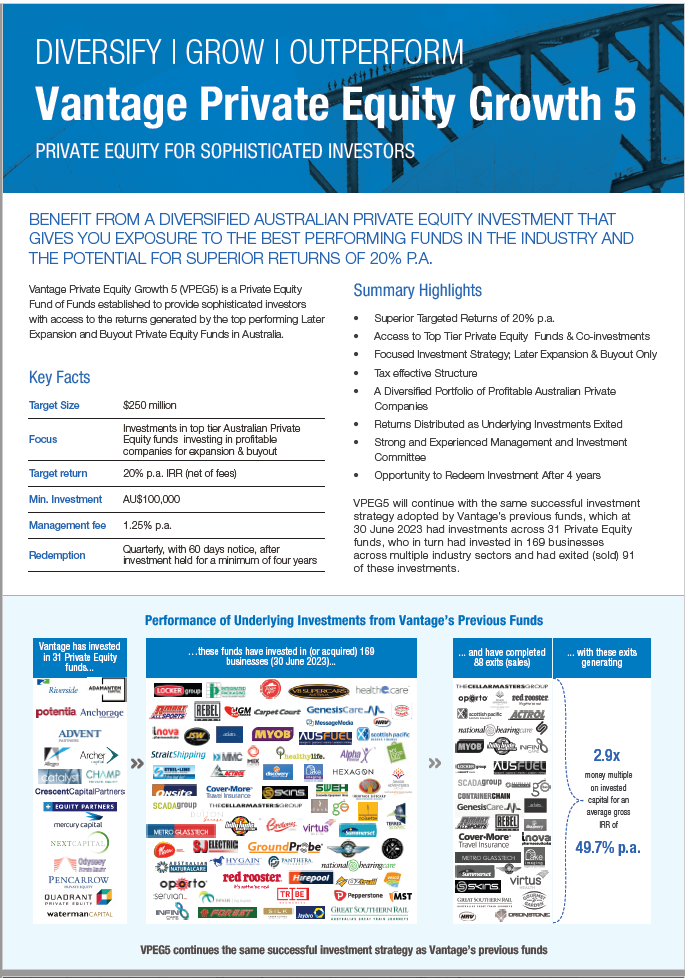

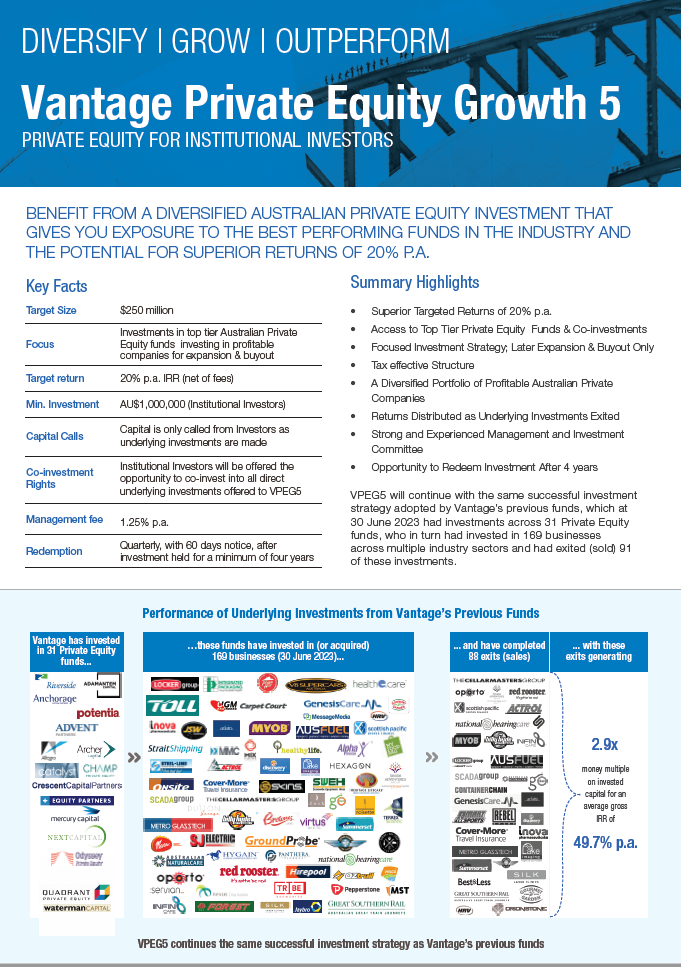

Superior Target Returns

VPEG5 is targeting a pre tax post fees return of 20% per annum over the medium to long term

Access to Previously Inaccessible Funds

Within two years of the Final Closing Date VPEG5 intends to have made investment commitments in up to eight Private Equity funds (both new & existing) managed by top performing Australian Private Equity fund managers, that are generally inaccessible to private Investors.

Focused Investment Strategy

VPEG5 will only invest in funds targeting small to mid market sized investments ($20m to $250m enterprise value at investment) at the Buyout and Later Expansion financing stages of Private Equity, that have consistently delivered strong returns to investors.

Tax Effective Fund Structure

VPEG5 is structured as an Incorporated Limited Partnership, Australian Fund of Funds (AFOF) regulated under the Venture Capital Act 2002 (Cth). This structure offers tax advantages to Investors (both local and foreign) in that all gains and income distributed by VPEG5 will be taxed in the hands of the Investor.

Certain investors will also benefit from the tax-exempt status of the Fund, applicable to capital gains and income received from the Fund under Innovation Australia’s ‘AFOF’ program.

A Well Diversified Private Equity Investment

VPEG5′s clearly defined Investment Guidelines provide a high level of diversification by strategically allocating its Private Equity Commitments and investments across fund managers, financing stages, industry sectors and geographic regions.

Returns Distributed as Underlying Investments Exited

As returns are realised by the Fund they will be distributed to Investors within 30 days of receipt, with any net income earned by the Fund during each financial year fully distributed to Investors each year.

Opportunity to Exit after Four Years

Investors may redeem their Investment in VPEG5, once held for a minimum of four years, which aligns with the end of the provisional visa period for the Significant Investor Visa.

Strong and Experienced Management and Investment Committee

VPEG5′s highly qualified and experienced investment management team is complemented by an Investment, Audit & Risk Committee consisting of a majority of independent members with substantial business, finance and Private Equity investment expertise.

Minimum Investment / Committed Capital

Institutional Investors:

$1,000,000 – partly paid on application

IV & SIV Applicants:

$500,000 – fully paid on application for IV Applicants

$1,000,000 – fully paid on application for SIV Applicants

Sophisticated Investors:

$100,000 – fully paid on application

Institutional Investors: Where the Committed Capital of an Applicant is at least $1,000,000, only 5% of the Committed Capital is required to be paid on Application prior to the relevant Closing Date. The remainder of the Committed Capital is subject to be paid across the life of the Fund, when a Capital Call is issued by the General Partner, to meet the Investors pro rata share of the obligations of the Fund, including the funding of underlying investments as they are made.