Vantage Private Equity Growth 5 (VPEG5) recently completed its first close with more than 212 investors committing approximately $37.0 million, enabling VPEG5 to commence its investment program. VPEG5 also remains open for investment for new investors and will conduct monthly closes until its target fund size of $250 million is reached.

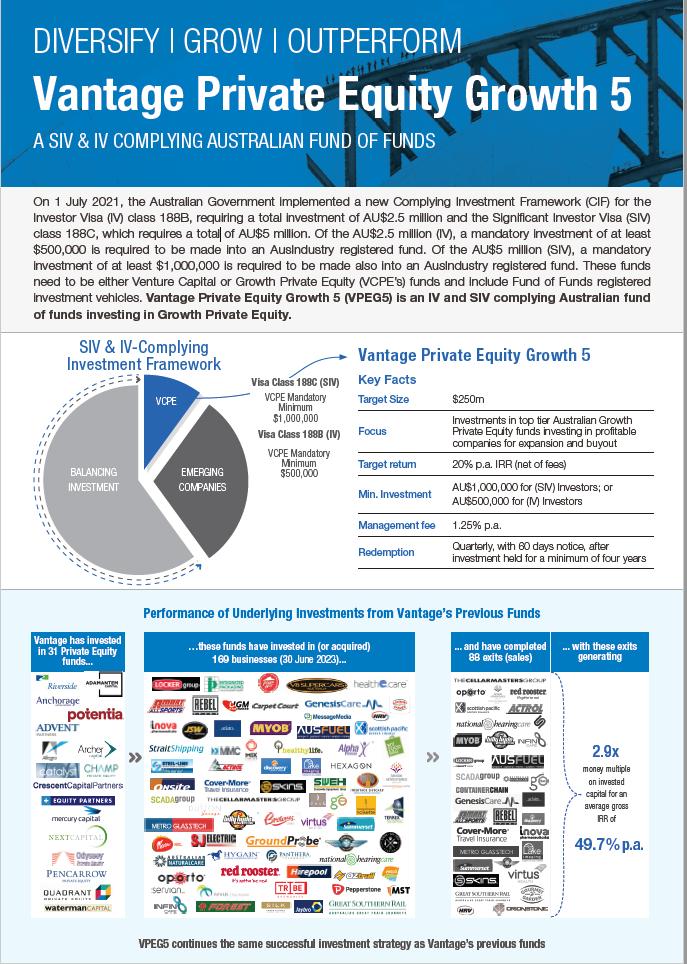

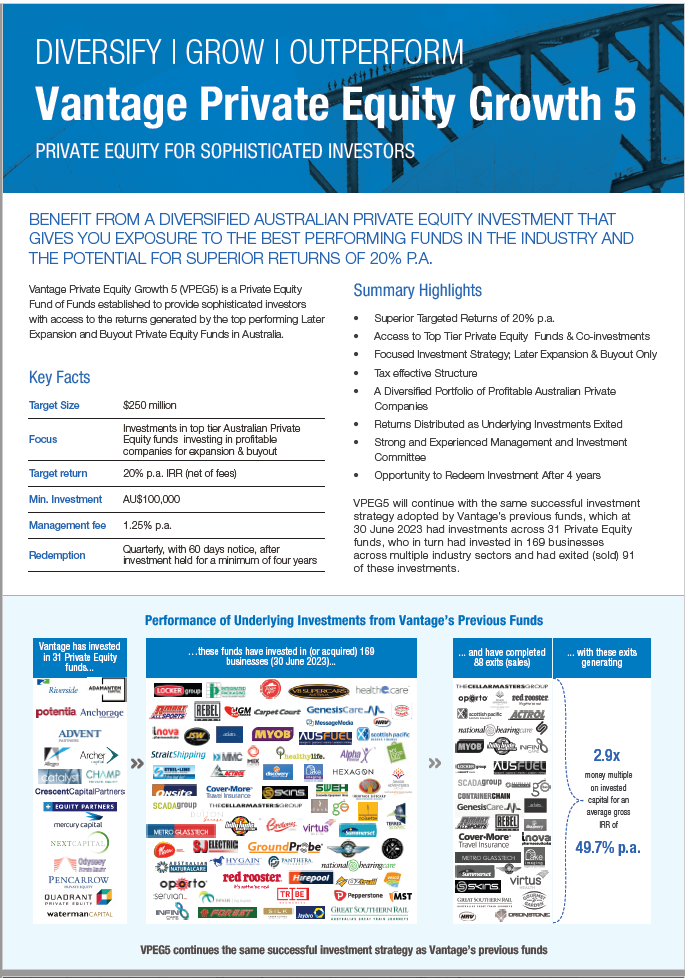

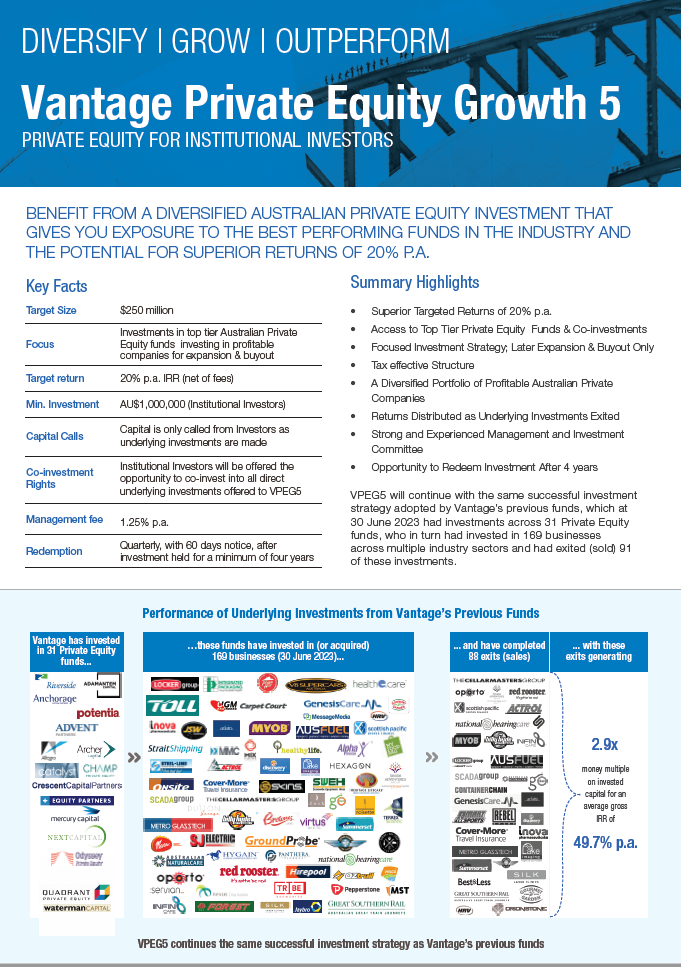

VPEG5 is an Australian Private Equity Fund of Funds established to provide investors with access to the superior returns consistently delivered by the top performing Later Expansion and Buyout Private Equity Funds in Australia.

VPEG5 will continue with the same successful investment strategy implemented by Vantage’s previous funds, which at 31 December 2021 had investments across 27 Australian Private Equity Funds, who in turn had invested in 149 companies across a broad range of industry sectors and had exited (sold) 70 of these investments generating a gross 3.1x multiple of invested capital for an average gross Internal Rate of Return for 41.8% per annum. VPEG5 is targeting to deliver a net return after fees of 20% p.a. to investors over a four to six-year investment timeframe.

If you would like to learn more about VPEG5 please contact your wealth manager or financial adviser. Alternatively if you would like to receive a call or request a meeting with a Vantage executive to discuss VPEG5 please call +61 2 9067 3133 or email [email protected]